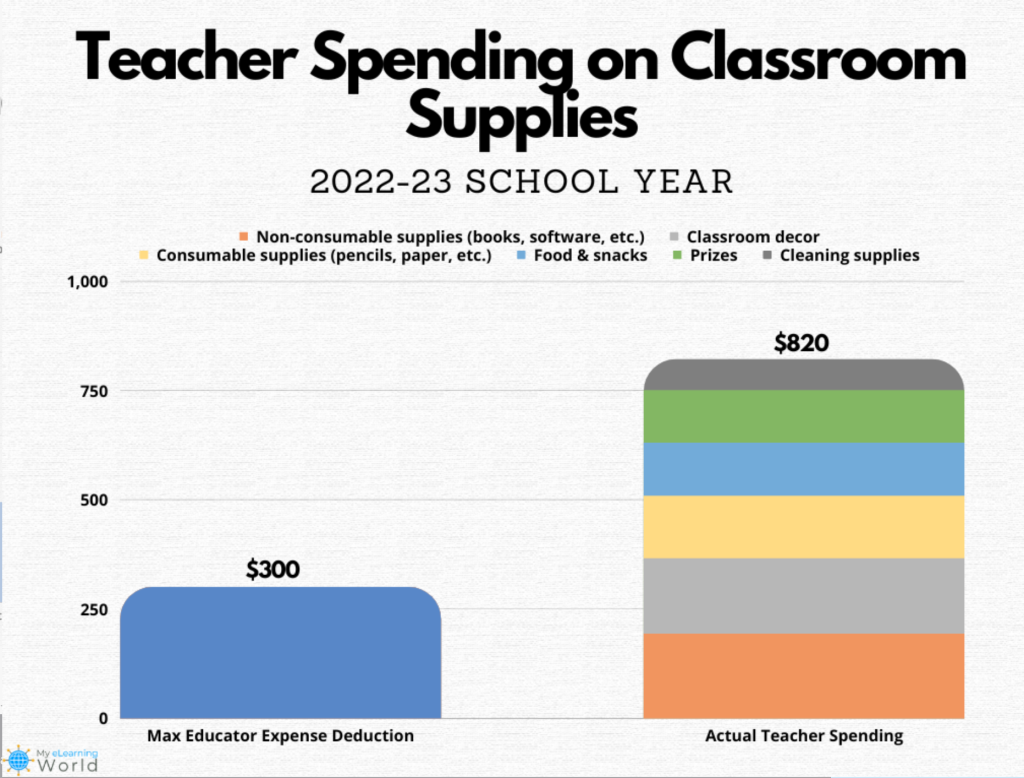

A new report by My eLearning World analyzes unreimbursed teacher spending on classrooms and comes to the conclusion that teachers will spend on average $820.14, and of that they will only be able to deduct $300 on their federal income tax.

Now it is ridiculous that teachers so commonly spend so much of their own money on school supplies, but it has been a problem for a while. Four years ago the TV series “What Would You Do” even filmed a segment about a teacher who couldn’t afford the school supplies and her groceries to see if bystanders would help.

But the issue here is not only that we expect teachers to pay for their own school supplies, but that, when it comes time to file taxes, we limit how much of their expenses they are allowed to deduct.

The deduction was instituted in 2002, and pegged at $250 where it stayed until 2022, which will be the first year it has increased, and luckily, will steadily increase each year from now on (side note: I can’t find the bill that made this change to the tax code, I suspect it is somewhere in the Build Back Better plan, but the links I was pouring through didn’t specify which bill was responsible for the increase). A bill was proposed this year by Rep. Anthony Brown from Maryland to jump the deduction up to $1,000 but it didn’t go very far.

At an increase of $50 per year, it will take a decade to reach the average level that teachers are spending on classrooms, but by that time, teacher spending could have increased a lot more. In 2015 the NEA did a survey and collected #OutOfPocket stories of teachers spending money out of pocket and found that on average teachers were spending $479 out of pocket, meaning that teacher spending has increased by about $48.71 per year! So if spending on school supplies continues to increase at the same rate, it will take 400 years for the deduction to catch up!

Now that is obviously ridiculous and spending won’t increase unbounded, but a $50 increase will not keep pace with teacher spending, and the limit needs to be raised now to a sensible level. Then we can tack on an increase as needed. Remember, the amounts listed here are all average amounts, so plenty of teachers will be left with classroom expenses (that are already coming out of their pocket) which they can’t even deduct on their taxes.

Much like the What Would You Do video above, individuals have been stepping up to help in ways they shouldn’t have to. All over #TeacherTwitter there are teachers who are posting their list of school supplies with the hashtag #ClearTheList2022 and people are making the purchases for them, but of course, unlike a donation to a charity, those individuals won’t be able to claim any kind of tax deduction either.

Teachers, the way each and every one of you are fighting for your students is inspirational. You’re underpaid, under appreciated, over worked, but you refuse to give up on your kiddos. Tip of the ? to you all! #bettertogether #clearthelist2022

— Hayes Holly (@HayesHolly2) August 9, 2022

Even still, it is heartwarming to see people coming together to help out teachers who need it, right now especially. If you can, search the hashtag on twitter and make a few purchases. #WhatWillYouDo?

More Stories

Tutoring as a part of teaching / Everything comes back to money

One of the difficult things with education is our reliance on a “one size fits all” model. We have for...

Justin Reich on Learning Loss, Subtraction in Action, and a future with much more disrupted schooling

Justin Reich is an education and technology researcher and the director of MIT’s Teaching Systems Lab. He hosts a podcast...

Public K-12 Enrollment is falling and that is dangerous and exciting

A surprising result of COVID and the resulting school closures is that many parents, after struggling to figure out how...

Esports could help re-diversify a shrunken curriculum

Esports and schools feel like a pretty strange fit. Regular sports have always gone with schools, but adding esports still...

Review of “How to Raise Successful People” by Esther Wojcicki

This is an interesting book with the perspective of a unique person that ultimately falters because of the blind spots...

SIGGRAPH at 50

SIGGRAPH , the premier conference on computer graphics education, held its 50th event last week in Los Angeles. Back in...