As we reported, Mississippi and North Carolina have confirmed that they are planning on taxing student loan forgiveness as income, and now Indiana has confirmed that they will as well. However, beyond the confirmed states, there are four more who are sitting on the fence. For those, the issue is that their current tax code doesn’t exactly follow federal policy, so if they do nothing then the forgiveness would automatically be taxed. And since several are not meeting for the remainder of 2022, it would take special orders to convene them to meet this year.

The four states in question are Arkansas, Minnesota, Wisconsin, and perhaps most surprisingly California. In our previous article we pointed out that the Tax Foundation predicted that Arkansas, Minnesota, and Wisconsin would tax the forgiveness, but did not originally include California (though they have now updated the article to include it).

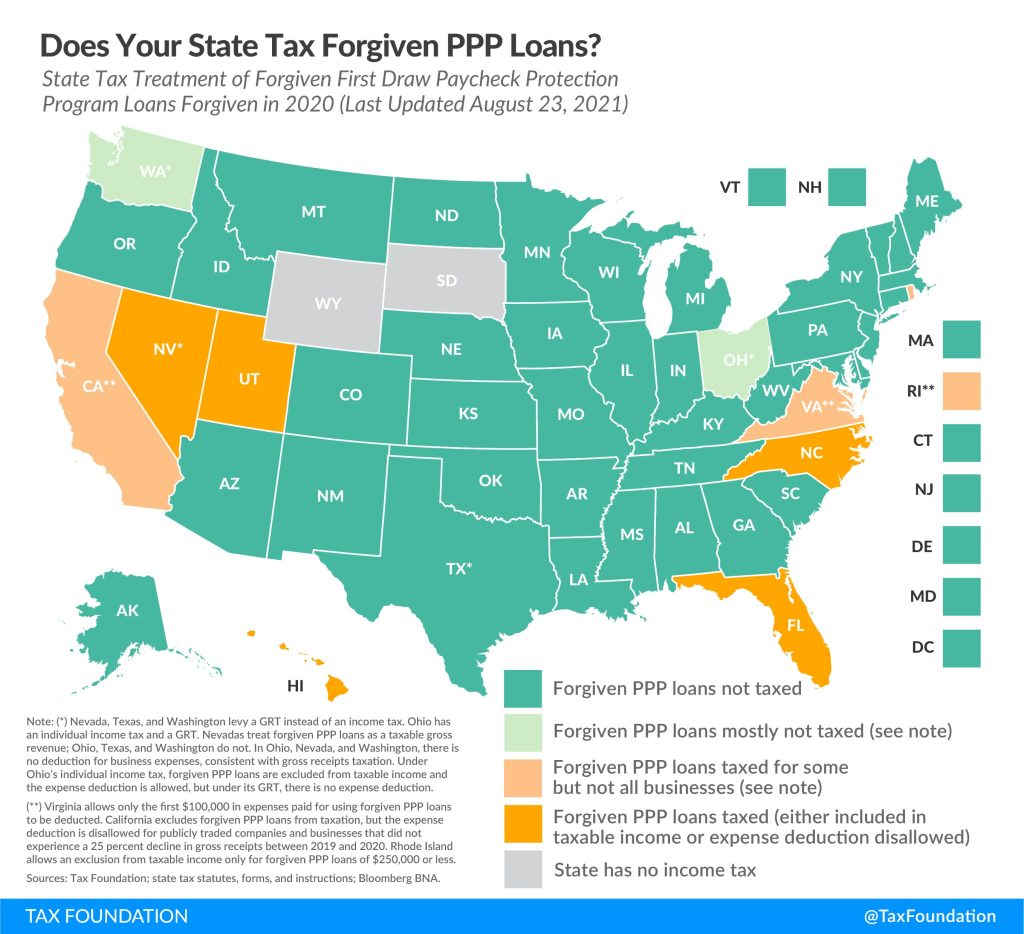

It is interesting to look at how this lines up with the states’ treatment of PPP loan forgiveness. Mississippi and possibly Arkansas, Minnesota, and Wisconsin are looking to tax student loan forgiveness after not treating PPP loans the same way. Nevada, Utah, Hawaii, Rhode Island, and Florida seem to trend the other direction, having taxed PPP loan forgiveness but not currently planning on taxing student loan forgiveness. And California and North Carolina are the two states which seem to be aiming for consistency in their tax policy (along with the other 36 who don’t seem to be taxing either).

But a surprise tax bill is not the only issue that is currently plaguing student loan borrowers. Navient, a student loan servicer, has sent out marketing emails trying to convince customers to refinance to their own private student loan company. This would mean that the borrowers would lose all access to the $10-20k student loan forgiveness. If you read the reddit thread posted below, you can see that they are explicitly capitalizing on the announcement regarding student loan forgiveness to try to sell their refinancing option. While there might theoretically be times to look into refinancing to a private loan, it would at least be better to wait until you have claimed all forgiveness that you are eligible for. And given the general climate around student loan cancellation, it is possible that Biden’s August 24th announcement won’t be the last time in the next few years that some federal student loan debt is canceled. So it is probably a bad time to trust any of their recommendations to refinance.

This is the third in our student loan forgiveness series. For the other two, look here and here.

2 thoughts on “Student loan forgiveness is a bit of a minefield”

Leave a Reply Cancel reply

More Stories

Tutoring as a part of teaching / Everything comes back to money

One of the difficult things with education is our reliance on a “one size fits all” model. We have for...

Public K-12 Enrollment is falling and that is dangerous and exciting

A surprising result of COVID and the resulting school closures is that many parents, after struggling to figure out how...

SIGGRAPH at 50

SIGGRAPH , the premier conference on computer graphics education, held its 50th event last week in Los Angeles. Back in...

School Board Meetings in Crisis

School Board meetings across the US have become a new flashpoint in the culture wars that have been dividing the...

Biden is forgiving $40 Billion in student loan debt through “administrative fixes”

We talk a lot about big, sweeping policy changes because those are the kind of things that make for easier...

The Supreme Court has taken aim at students

The republican majority supreme court has now decided two important cases we’ve previously reported on; Biden’s student debt forgiveness and...

It’s not only the tuition fees but also the scholarships never goes to people that really needed like part time students. However, when applying for scholarships is always for full time students fresh out of high school. Therefore, not even considered towards the adults students with family and financial responsibilities. Instead they should focus more on adults students because they are more likely to graduate than younger students.

It is certainly true that the focus is on students right out of High School and only recently has there been much support for adult students. School administrators are very focused on the 18 year old students and I have seen support cut for adult students, maybe because it doesn’t fit everyone’s idea of what a “college student” looks like. I do wish there was more support, scholarships, and interest focused on adult students, especially because, like you pointed out, they are more likely to graduate and more likely to have a better GPA.